India’s loan frauds amount to almost $10 billion in 8,670 cases

India’s loan frauds amount to almost $10 billion in 8,670 cases

Figure represents the period over last five financial years up to March 31, 2017

NEW DELHI, MUMBAI: Investors may have been shocked when one of India’s biggest banks disclosed a $1.77 billion fraud by a billionaire jeweller, but the central bank has recorded data that shows the problem runs far deeper and wider.

Reserve Bank of India (RBI) data, which a Reuters reporter obtained through a right-to-information request, shows state-run banks have reported 8,670 “loan fraud” cases totalling Rs612.6 billion (Dh35.1 billion, $9.58 billion) over the last five financial years up to March 31, 2017.

In India, loan frauds typically refer to cases where the borrower intentionally tries to deceive the lending bank and does not repay the loan.

The figures expose the magnitude of the problem in a banking sector already under pressure after years of poor lending practices. Bad loans surged to a record peak of nearly $149 billion last year.

Bank loan frauds have steadily increased as well, reaching 176.34 billion rupees in the latest financial year from 63.57 billion rupees in 2012-13, according to the data, which doesn’t include the PNB case.

Punjab National Bank, India’s second-largest state lender, said on Wednesday two junior officers at a single branch had illegally steered $1.77 billion in fraudulent loans to companies, most of them controlled by billionaire jeweller Nirav Modi. It was India’s biggest fraud ever.

“This might be the tip of the iceberg or the middle, and that is the worry,” said Pratibha Jain, partner at law firm Nishith Desai Associates, who advises on bankruptcy cases.

“The fact is we don’t know what else is out there.”

Bank disclosures

The RBI did not immediately respond to a request for comment. But in June 2017 the central bank, in its Financial Stability Report, called frauds in banks and financial institutions “one of the emerging risks to the financial sector”.

“In a number of large value frauds, serious gaps in credit underwriting standards were evident,” the RBI said, adding that some of the gaps include lack of continuous monitoring of cash flows and cash profits, diversion of funds, double financing and general credit governance issues in banks.

The RBI has been commended for forcing Indian banks to fully disclose its bad loans, speed up their recovery, and stop hiding fraud cases as non-performing assets.

Yet to some critics, the RBI has, at the same time, been too guarded about publicly sharing data on loan defaults or fraudulent loans. This is partly due to legal constraints on disclosing individual cases and worries investors would pummel the affected banks, making loan recovery even harder.

In fact, the numbers of loan fraud cases across India could be even higher since they only include cases reported to the RBI, which involve only loans of 100,000 rupees or more.

In its right-to-information request, Reuters sought data from 20 of India’s 21 state-run lenders and obtained 15 replies.

PNB topped the list with 389 cases totalling Rs65.62 billion over the last five financial years, in terms of the total amounts involved.

Reuters was unable to obtain a detailed breakdown on the exact nature and method of the loan frauds the banks reported to RBI over the last five financial years.

After PNB, Bank of Baroda had the highest amount of loan fraud reported, with Rs44.73 billion from 389 cases and Bank of India ranked third, with loan frauds totalling Rs40.5 billion from 231 cases over the same period, the data shows.

India’s biggest lender, State Bank of India reported 1,069 loan fraud cases in the last five financial years but did not disclose the amount.

It was also unclear how much has been recovered by the banks over the years.

Wholesale reforms

The magnitude of the bad debt in India forced the government last year to bail out the sector by pledging to inject $32 billion over this financial year and next.

Yet analysts and credit rating agencies have long warned that solving the bad debt at India’s banking sector needs to also involve wholesale reforms of the lending practices that led to the surge in bad loans.

Bankers have been blamed for steering funds to politically connected business tycoons, such as Vijay Mallya, without due diligence, or after being pressed by government officials to steer funds to sectors it wanted to promote, such as infrastructure.

Mallya stands accused in India of fraudulently palming off losses from his now defunct Kingfisher Airlines onto banks by taking out loans he had no intention of repaying, an allegation he denies.

Nirav Modi, the jeweller accused in the PNB fraud case, posed for pictures with Indian Prime Minister Narendra Modi at the World Economic Forum in Davos, Switzerland, where he was part of India’s delegation of corporate leaders.

The ruling Bharatiya Janata Party has denied any link with Nirav Modi, who is not related to India’s Prime Minister.

Please note that under 66A of the IT Act, sending offensive or menacing messages through electronic communication service and sending false messages to cheat, mislead or deceive people or to cause annoyance to them is punishable. It is obligatory on kemmannu.com to provide the IP address and other details of senders of such comments, to the authority concerned upon request. Hence, sending offensive comments using kemmannu.com will be purely at your own risk, and in no way will Kemmannu.com be held responsible.

Similarly, Kemmannu.com reserves the right to edit / block / delete the messages without notice any content received from readers.

Rozaricho Gaanch April, 2024 - Ester issue

Final Journey Of Theresa D’Souza (79 years) | LIVE From Kemmannu | Udupi |

Invest Smart and Earn Big!

Creating a World of Peaceful Stay!

For the Future Perfect Life that you Deserve! Contact : Rohan Corporation, Mangalore.

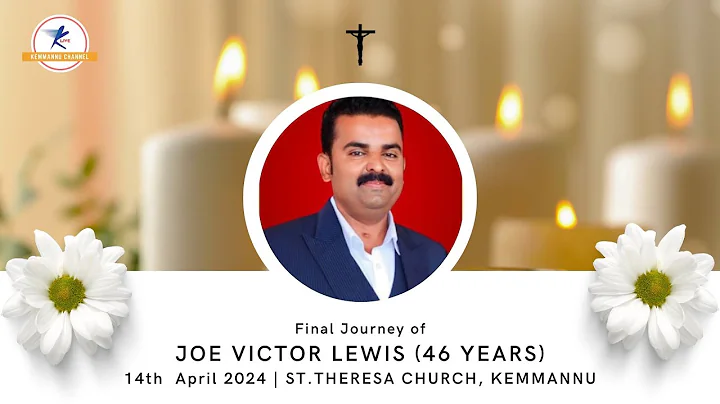

Final Journey Of Joe Victor Lewis (46 years) | LIVE From Kemmannu | Organ Donor | Udupi |

Milagres Cathedral, Kallianpur, Udupi - Parish Bulletin - Feb 2024 Issue

Easter Vigil 2024 | Holy Saturday | St. Theresa’s Church, Kemmannu, Udupi | LIVE

Way Of Cross on Good Friday 2024 | Live From | St. Theresa’s Church, Kemmannu, Udupi | LIVE

Good Friday 2024 | St. Theresa’s Church, Kemmannu | LIVE | Udupi

2 BHK Flat for sale on the 6th floor of Eden Heritage, Santhekatte, Kallianpur, Udupi

Maundy Thursday 2024 | LIVE From St. Theresa’s Church, Kemmannu | Udupi |

Kemmennu for sale 1 BHK 628 sqft, Air Conditioned flat

Symphony98 Releases Soul-Stirring Rendition of Lenten Hymn "Khursa Thain"

Palm Sunday 2024 at St. Theresa’s Church, Kemmannu | LIVE

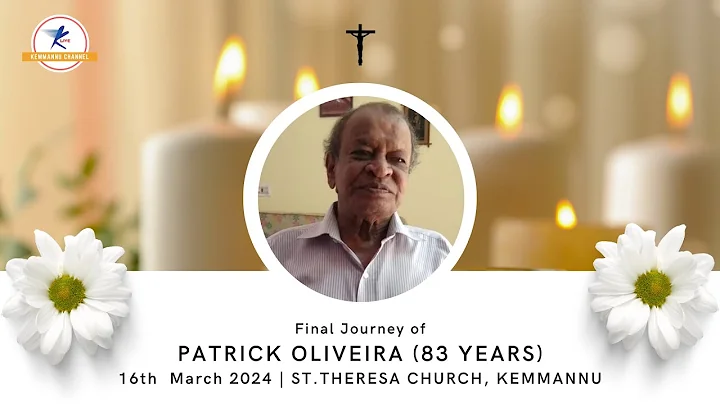

Final Journey of Patrick Oliveira (83 years) || LIVE From Kemmannu

Carmel School Science Exhibition Day || Kmmannu Channel

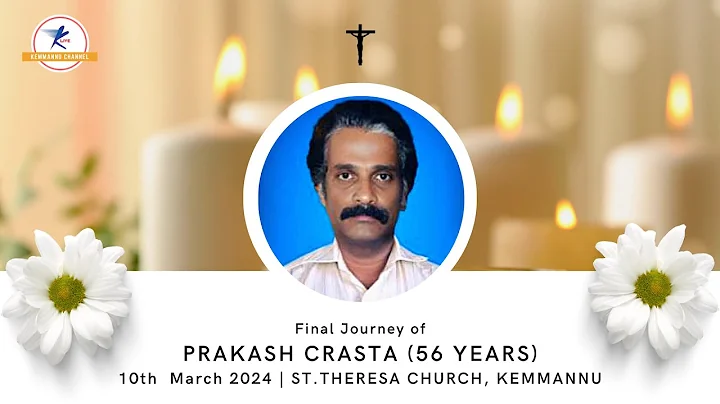

Final Journey of Prakash Crasta | LIVE From Kemmannu || Kemmannu Channel

ಪ್ರಗತಿ ಮಹಿಳಾ ಮಹಾ ಸಂಘ | ಸ್ತ್ರೀಯಾಂಚ್ಯಾ ದಿಸಾಚೊ ಸಂಭ್ರಮ್ 2024 || ಸಾಸ್ತಾನ್ ಘಟಕ್

Valentine’s Day Special❤️||Multi-lingual Covers || Symphony98 From Kemmannu

Rozaricho Gaanch December 2023 issue, Mount Rosary Church Santhekatte Kallianpur, Udupi

An Ernest Appeal From Milagres Cathedral, Kallianpur, Diocese of Udupi

Diocese of Udupi - Uzvd Decennial Special Issue

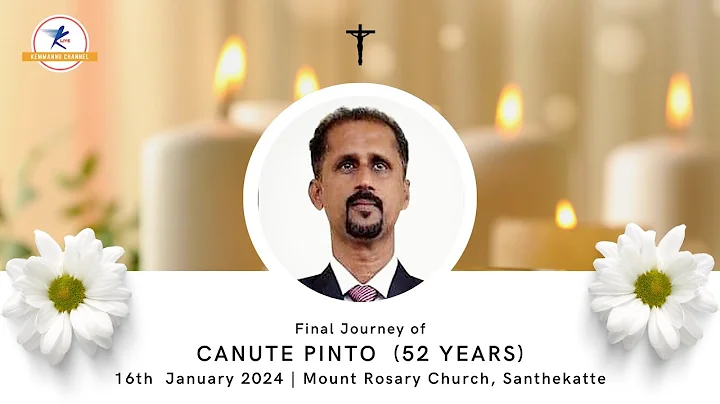

Final Journey Of Canute Pinto (52 years) | LIVE From Mount Rosary Church | Kallianpura | Udupi

Earth Angels Anniversary | Comedy Show 2024 | Live From St. Theresa’s Church | Kemmannu | Udupi

Confraternity Sunday | St. Theresa’s Church, Kemmannu

Kemmannu Cricket Match 2024 | LIVE from Kemmannu

Naturya - Taste of Namma Udupi - Order NOW

New Management takes over Bannur Mutton, Santhekatte, Kallianpur. Visit us and feel the difference.

Focus Studio, Near Hotel Kidiyoor, Udupi

Earth Angels - Kemmannu Since 2023

Kemmannu Channel - Ktv Live Stream - To Book - Contact Here

Click here for Kemmannu Knn Facebook Link

Sponsored Albums

Exclusive

An Open ground ‘Way of the Cross’ observed in St. Theres’s Church, Kammannu. [Live-Streamed]

Udupi Bishop Most Rev. Gerald Issac Lobo Celebrates Palm Sunday at Kemmannu Church

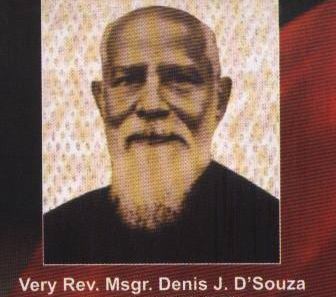

The architect of various Churches, Schools, Hospitals and Colleges….. Msgr Denis Jerome D Souza.

Konknani Writers’ Association Literary Award Conferred on Dr. Gerald Pinto

Celebrating Love Across Languages: A Valentine’s Day Special

Udupi: Kemmannu.com Journo Richard D’Souza Felicitated by Paryaya Sri, Sri Sugunendra Tirtha Swamiji.

Let the unity of senior players be an example to the youth - Gautham Shetty - Alfred Crasto Felicitation - Match Livestream.

Bali, Indonesia: Royal Singaraja Award to Mangalorean NRI Philanthropist Dr. Frank Fernandes. [Video]

MTC - Milagres towards Community – An Outreach program on 14th December, 2023

TODAY -

TODAY -

Write Comment

Write Comment E-Mail To a Friend

E-Mail To a Friend Facebook

Facebook Twitter

Twitter  Print

Print