IFCI Limited to raise Rs.2,000 crore through Public issue of Secured Debentures

Kemmannu News Network, 17-10-2014 20:02:28

MUMBAI, October 17, 2014: IFCI Limited (“Company” or “IFCI”), a company promoted and controlled by Government of India, is, subject to market conditions and other considerations, proposing a public issue of secured redeemable non-convertible debentures (“NCDs”) of face value of Rs. 1,000 each amounting to Rs. 250.00 crore (“Base Issue Size”) with an option to retain oversubscription aggregating upto the Shelf Limit i.e. Rs 2,000.00 crore.

The NCDs are rated “BWR AA- (Outlook: Stable)” by Brickwork Rating India Private Limited. Instruments with this rating are considered to have the high degree of safety regarding timely servicing of financial obligations. Such instruments carry very low credit risk. The NCDS are rated “[ICRA]A (Stable)” by ICRA Limited. Instruments with this rating are considered to have the adequate degree of safety regarding timely servicing of financial obligations. The NCDs are proposed to be listed on the BSE Limited (“BSE”) and National Stock Exchange of India Limited (“NSE”). The designated Stock Exchange for the Issue is BSE.

SBI Capital Markets Limited, A.K. Capital Services Limited, Edelweiss Financial Services Limited and RR Investors Capital Services Private Limited are the Lead Managers to the issue. Axis Trustee Services Limited has pursuant to regulation 4(4) of SEBI Debt Regulations given its consent for its appointment as Debenture Trustee to the Issue and Karvy Computershare Private Limited is the Registrar to the Issue. Dhir & Dhir Associates is the Legal Counsel to the Issue.

The NCDs with a tenure of 5 years, having annual coupon payout option, will have a coupon rate of 9.80% p.a. for all categories of Investors i.e Category I Investor i.e. Qualified Institutional Buyers (“QIB”), Category II Investor i.e. Corporates, Category III Investor i.e. High Networth Individuals (“HNIs”) and Category IV Investor i.e. Retail Individual Investors (“RII”). There is an additional incentive of 0.10% p.a over coupon rate applicable only for HNIs and RII. Thus, the aggregate of coupon rate and additional incentive for HNIs and RII is 9.90% p.a.

The NCDs with tenure of 5 years, having monthly coupon payout option, will have a coupon rate of 9.40% p.a. (effective yield of 9.81% p.a) for all categories of Investors i.e QIB, Corporates, HNIs and RII. There is an additional incentive of 0.10% p.a over coupon rate applicable only for HNIs and RII. Thus, the aggregate of coupon rate and additional incentive for HNIs and RII is 9.50% p.a (effective yield of 9.92% p.a).

The NCDs with tenure of 7 years and 10 years have annual coupon payout option, and will have a coupon rate of 9.90% p.a for all categories of Investors i.e QIB, Corporates, HNIs and RII. There is an additional incentive of 0.10% p.a over coupon rate applicable only for HNIs and RII. Thus, the aggregate of coupon rate and additional incentive for HNIs and RII is 10.00% p.a.

The Company is also offering NCDs with cumulative option for all three tenures i.e. 5 years, 7 years and 10 years. The NCDs of face value of Rs. 1,000 with a tenure of 5 years will be redeemed on the Maturity Date at Rs. 1,596.33 (QIB and Corporates) and Rs. 1,603.62 (HNIs and RII). The NCDs of face value of Rs. 1,000 with tenure of 7 years will be redeemed on the Maturity Date at Rs. 1,937.55 (QIB and Corporates) and Rs. 1,949.73 (HNIs and RII). The NCDs of face value of Rs. 1,000 with tenure of 10 years will be redeemed on the Maturity Date at Rs. 2,572.25 (QIB and Corporates) and Rs. 2,595.78 (HNIs and RII).

About IFCI Limited: IFCI is promoted and controlled by Government of India. The President of India, acting through Ministry of Finance, Government of India holds 55.53 percent of the equity shares of IFCI. IFCI is registered as Systematically Important Non-Deposit taking Non-Banking Finance Company (NBFC-ND-SI) with the Reserve Bank of India. IFCI has also been notified as a “Public Financial Institution” (PFI) by the Ministry of Corporate Affairs, Government of India. Along with the group entities, the Company provides financial services which include, besides long term corporate loans, advisory services in the areas of Project Development, Project Appraisal, Strategic Analysis, Corporate Restructuring, Infrastructure Financing and Legal Advisory to certain sectors. IFCI has 16 regional offices in different cities across India.

Its equity shares are listed on the prominent stock exchanges in India namely BSE and NSE.

IFCI’s net profit margin for Fiscal 2014, 2013 and 2012 stood at 17.22%, 16.34% and 23.28%, respectively.Cumulative gross loans sanctioned by IFCI, as at June 30, 2014, on a standalone basis, aggregated to Rs. 95,897.28 crore, in 5175 projects with total disbursement of Rs. 83,137.80 crore. As at June 30, 2014, the Company’s Capital Adequacy Ratio calculated on the basis of applicable RBI requirement was 20.84 % as compared to a minimum of capital adequacy requirement of 15% stipulated by RBI.

Capitalized term used and not define herein shall have the same meaning assigned to such terms in the Tranche 1 Prospectus and Shelf Prospectus (which are collectively referred to as “Prospectus”)

Disclaimer:

Disclaimer of the Issuer: IFCI Limited is proposing, subject to receipt of requisite approvals, market conditions and other considerations, a public issue of its secured, redeemable, non-convertible debentures (NCDs) and has filed the Shelf Prospectus and Prospectus Tranche-I both dated October 13, 2014 with BSE Limited (BSE), National Stock Exchange of India Limited (NSE) and Securities Exchange Board of India (SEBI). The Shelf Prospectus and the Prospectus Tranche-I is available on the website of SEBI at www.sebi.gov.in, the website of the BSE at www.bseindia.com, the website of the NSE at www.nseindia.com, the website of the IFCI Limited at www.ifciltd.com and the websites of the Lead Managers at www.sbicaps.com, www.akcapindia.com, www.edelweissfin.com and www.rrfcl.com/www.rrfinance.com, respectively. Physical copies of the Shelf Prospectus and Prospectus Tranche I can be obtained from the Company’s Registered Office and Regional Offices, as well as offices of the Lead Managers. The Investors are advised to refer to the Prospectus, and the risk factors

contained therein, before applying in the Issue. Please see the section titled “Risk Factors” beginning on page 9 of the Shelf Prospectus for the risks in this regard.

Disclaimer clause of BSE: It is to be distinctly understood that the permission given by BSE Limited should not in any way be deemed or construed that the Prospectus has been cleared or approved by BSE Limited nor does it certify the correctness or completeness of any of the contents of the Prospectus. The investors are advised to refer to the Shelf Prospectus for the full text of the “Disclaimer Clause of BSE”.

Disclaimer clause of NSE: It is to be distinctly understood that the aforesaid permission given by NSE should not in any way be deemed or construed that the Prospectus has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Prospectus. The investors are advised to refer to the Shelf Prospectus for the full text of the “Disclaimer Clause of NSE”.

Disclaimer clause of RBI: The Company is having a valid Certificate of Registration dated August 18, 2009 issued by the Reserve Bank of India under section 45 IA of the Reserve Bank of India Act, 1934. However, the RBI does not accept any responsibility or guarantee about the present position as to the financial soundness of the Company or for the correctness of any of the statements or representations made or opinions expressed by the Company and for repayment of deposits/ discharge of liability by the Company.

Please note that under 66A of the IT Act, sending offensive or menacing messages through electronic communication service and sending false messages to cheat, mislead or deceive people or to cause annoyance to them is punishable. It is obligatory on kemmannu.com to provide the IP address and other details of senders of such comments, to the authority concerned upon request. Hence, sending offensive comments using kemmannu.com will be purely at your own risk, and in no way will Kemmannu.com be held responsible.

Similarly, Kemmannu.com reserves the right to edit / block / delete the messages without notice any content received from readers.

Mount Rosary Church - Rozaricho Gaanch May 2025 Issue

Final Journey of Juliana Machado (93 years) | LIVE from Udyavara | Udupi

Final Journey of Charles Pereira (78 years) | LIVE from Kemmannu

Milarchi Laram, Milagres Cathedral, Kallianpur, Diocese of Udupi, Bulletin - April 2025

Holy Saturday | St. Theresa Church, Kemmannu

Good Friday 2025 | St. Theresa Church, Kemmannu

Way of Cross | St. Theresa Church, Kemmannu

Maundy Thursday | St. Theresa Church, Kemmannu

Palm Sunday | St. Theresa Church, Kemmannu

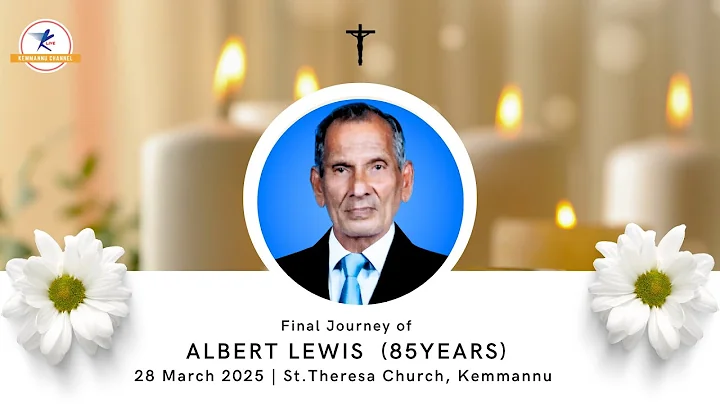

Final Journey of Albert Lewis (85years) | LIVE From St Theresa’s Church Kemmannu | Udupi

Final Journey of Gregory D’Souza (79 years) | LIVE from Kemmannu

Final Journey of Bernard G D’Souza | LIVE from Moodubelle

Final Journey of Jacintha Serrao (66 years) | LIVE From Sasthan

Earth Angels Kemmannu Unite: Supporting Asha Fernandes on Women’s Day

ಅಂತರಾಷ್ಟ್ರೀಯ ಮಹಿಳಾ ದಿನಾಚರಣೆ | ಕಲ್ಯಾಣಪುರ ವಲಯ

Final Journey of Joseph Peter Fernandes (64 years) | LIVE From Milagres, Kallianpur, Udupi

ಕಾಜಾರಿ ಜೊಡ್ಯಾಂಚೊ ದೀಸ್ | ಸಾಂ. ಅಂತೊನ್ ಫಿರ್ಗಜ್, ಸಾಸ್ತಾನ್

Final Journey of Leo J. Crasto (97 years) | LIVE from Kemmannu, Udupi

Final Journey of Fedrick Lewis (67 years) | LIVE from Santhekatte

Final Journey of Mr. Charles D’Souza (63 years) | LIVE from Udyavar

Final Journey Of Richard Sequeira | Live From Barkur || Kemmannu channel

Milagres Cathedral, Kallianpur, Udupi - Parish Bulletin - January 2025 Issue

Rozaricho Gaanch 2024 December Issue - Mount Rosary Church, Santhekatte

0:24 / 2:30:40 NEW YEAR MASS 2025 | LIVE from Kemmannu | Diocese of Udupi

Land/Houses for Sale in Kaup, Manipal, Kallianpur, Santhekatte, Uppor, Nejar, Kemmannu, Malpe, Ambalpady.

Naturya - Taste of Namma Udupi - Order NOW

Focus Studio, Near Hotel Kidiyoor, Udupi

Earth Angels - Kemmannu Since 2023

Click here for Kemmannu Knn Facebook Link

Sponsored Albums

Exclusive

A Saintly Shepherd of Our Times: A Tribute to Pope Francis

Servant of God – Fr Alfred Roche, Barkur -Closing ceremony of Birth Centenary Celebrations.

"Raav Sadanch" – A Konkani Musical Masterpiece by Young Prodigy Renish Tyson Pinto, Barkur Inspires Youth to Chase Their Passions.

Bishop Rt. Rev. Dr. Gerald Isaac Lobo, Offers the Solemn Thanksgiving Jubilee Mass, in Milagres Cathedral

GOLDEN YEARS, HAPPIER TOGETHER….by P. Archibald Furtado

Parish Level inaugural Badminton Little Flower Cup 2024 held in Kemmannu.

Udupi: Foundation stone laid for the SVP sponsored new house at Kemmannu

KAMBALA – A FORGOTTEN SPORT OF YESTER YEARS…..

Monti Phest: A Rich Heritage of South Canara - By Fr. Anush D’Cunha SJ

TODAY -

TODAY -

Write Comment

Write Comment E-Mail To a Friend

E-Mail To a Friend Facebook

Facebook Twitter

Twitter  Print

Print

2.jpg)