Beware, India’s Economy Is On Autopilot by Prof. Gourav Vallabh

Beware, India’s Economy Is On Autopilot by Prof. Gourav Vallabh

When you are unwell, you need a doctor. When your car has broken down, you need a mechanic. When you need 20 off the last over, you look up to MS Dhoni. In crisis, you look to an expert to bail you out. A crisis demands a series of calculated measures that can fetch positive results. Unfortunately, the current economic cockpit is being controlled by pilots who seem to be lost and have left the economy on autopilot for too long, hoping for it to find its own way. The Finance Ministry came up with a set of measures on Monday that they chose to refer as fiscal stimulus package. The only thing worth welcoming about this was the acknowledgement that consumer demand is perhaps at an all-time low and deserves attention.

This is the second fiscal stimulus package that the Finance Minister has announced ever since economic activities came to an abrupt halt due to COVID-19. The natural effect of such an economic closure was on jobs. With 2.1 crore people losing jobs and millions of others insecure about job losses or pay cuts, it is evident that consumer demand will fall.

Although mandatory spending on food, electricity, etc. wasn’t too badly affected, discretionary spend like shopping, gifts, travel took a severe hit. During the first fiscal stimulus announcement in May 2020, as an economist, I expected the government to announce a balanced set of measures to boost both supply and demand. What was disappointing was that although the 20 lakh crore package announced then served well as a marketing gimmick, most of it was focused on credit expansion and debt restructuring. The component of actual expenditure of the government was only close to 5%. The credit rating agencies have shown their assessment of these measures with each agency massively downgrading India’s GDP growth forecast for FY 2020-21 in July-August from their earlier estimates in April-May.

Boosting consumer demand was the key focus of the government in Fiscal Stimulus 2.0, announced on Monday. I strongly argue that comes six months too late. Four major areas that the government has narrowed down on to spur demand: LTC cash voucher scheme for government employees; festival advance of ₹ 10,000; an extra ₹ 12,000 crore to states for capital expenditure; and ₹ 25,000 crore to be spent by the central government as capital expenditure. Firstly, I believe the government either doesn’t understand or wishes to conveniently ignore the essence of a stimulus - which is extra or additional money being pumped in. Moving money from one pocket to another might be appreciated to those who are fans of trickery, but it is a joke as far as fiscal stimulus is concerned. The festival advance is an interest-free loan; it will be deducted from their paycheques in installments. Through this scheme, the government seems to be suggesting credit as the route for liquidity. Through the LTC Cash voucher scheme, central government employees are being nudged to buy goods that draw a larger than 12% GST at a GST-registered store in non-cash form. Also, back of the envelope calculations suggest that if the LTA amount available is ₹ 15,000, to get the entire amount as tax exempt, one would need to spend ₹ 45,000. A real stimulus would have been the decision to go ahead with the Dearness Allowance hike from 17% to 21% which the centre has suspended till June next year.

The other announcement was around providing ₹ 12,000 crore to states for capital expenditure. Although increasing spending through capital expenditure is a welcome move, the question is: how much more money was given to states? A paltry 1.33% more. The states’ total capital expenditure budget for FY21 is nearly ₹ 9 lakh crores. What will a meagre ₹ 12,000 crore do and how will it "stimulate" states to spend more on capital expenditure?

The only onus that the central government has taken is committing on spending an additional ₹ 25,000 crores on capital expenditure, which, by the way, is just a 6% increase over and beyond the budgeted Rs 4.13 lakh crore for capital expenditure. It’s like the king asking his army to win the war but refusing to leave his own den.

The economic growth of a nation occurs on account of three levers: consumption, savings and investment. Credit growth has been stagnant indicating a weak credit demand. On the other hand, deposit growth witnessed a 10.9% rise year-on-year. This clearly indicates that people prefer savings against either investment or consumption - and credit is not the answer to the current crisis.

In order to spur demand, the government must:

- Increase its own capital expenditure to reignite the economy. This will not only push the growth of core sectors but also help create more jobs and allay the fears of uncertainty among consumers

- Clear all pending dues to states which will allow them to further invest, create job opportunities and spur consumer spending

- An unemployment benefit mechanism should be instituted with a separate allocation to push money into the hands of the unemployed

Credit is not the answer at the moment. Cash in the hands of the needy is the need of the hour.

(The writer is Professor of Finance and National Spokesperson, Congress Party.)

Please note that under 66A of the IT Act, sending offensive or menacing messages through electronic communication service and sending false messages to cheat, mislead or deceive people or to cause annoyance to them is punishable. It is obligatory on kemmannu.com to provide the IP address and other details of senders of such comments, to the authority concerned upon request. Hence, sending offensive comments using kemmannu.com will be purely at your own risk, and in no way will Kemmannu.com be held responsible.

Similarly, Kemmannu.com reserves the right to edit / block / delete the messages without notice any content received from readers.

Final Journey of Mr. Michael Braganza (86 Years) | LIVE From Kundapura

Milarchi Lara, Milagres Cathedral, Kallinapur, Udupi District - Parish Bulletin_ January 2026

Rozaricho Gaanch Jan 2026 Issue From Mount Rosary Church, Kallianpur, Santhekatte, Udupi.

Final Journey of Veronica Precilla D’Souza (76 Years) | LIVE From Kallainpur

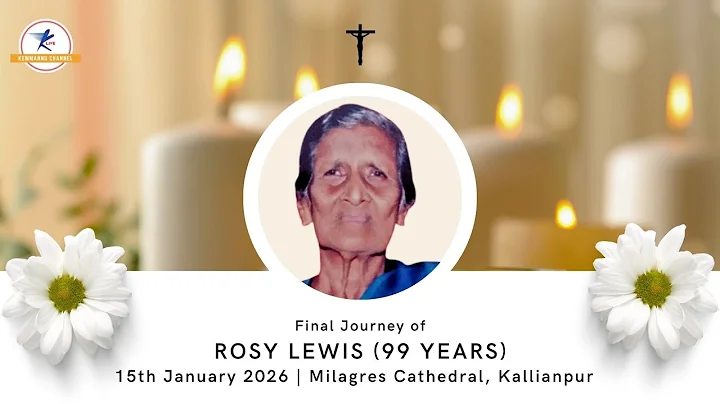

inal Journey Of Rosy Lewis (99 Years) | LIVE from Milagres, Kallianpur, Udupi

Final Journey Of George Miranda (79 Years) | LIVE from Udupi

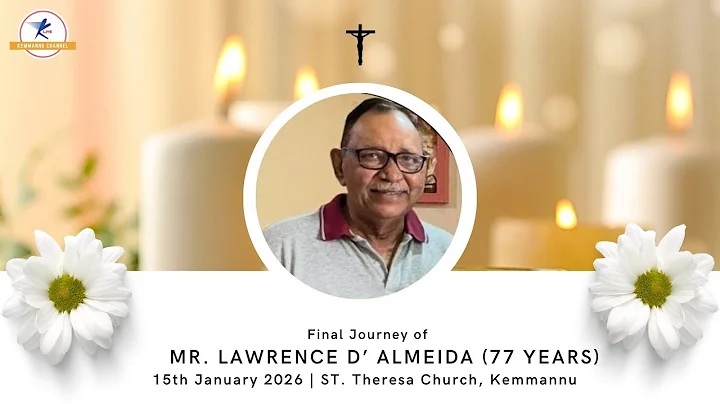

Final Journey of Mr. Lawrence D,Almeida (77 years) | LIVE from Kemmannu | Udupi

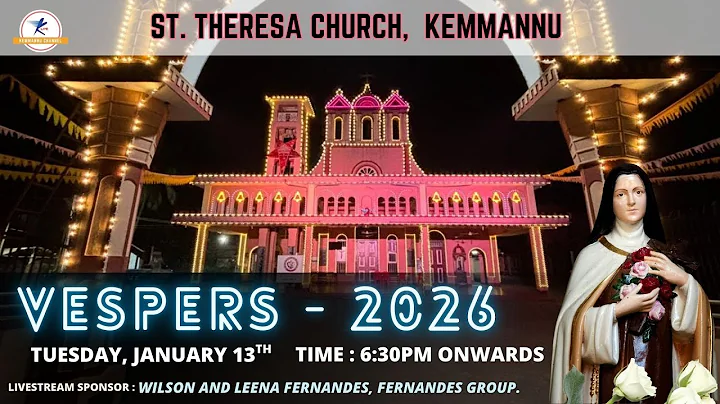

Vespers 2026 | St Theresa’s Church, Kemmannu | Udupi

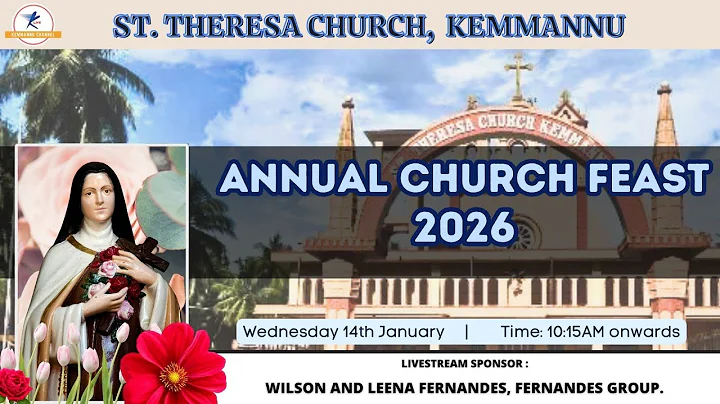

Annual Church Feast 2026 | St Theresa’s Church, Kemmannu | Udupi

IN Final Journey Of Prescilla Quadros (83 Years) | LIVE From Kemmannu | Udupi

Vespers 2026 | Mount Rosary Church, Santhekatte | Udupi

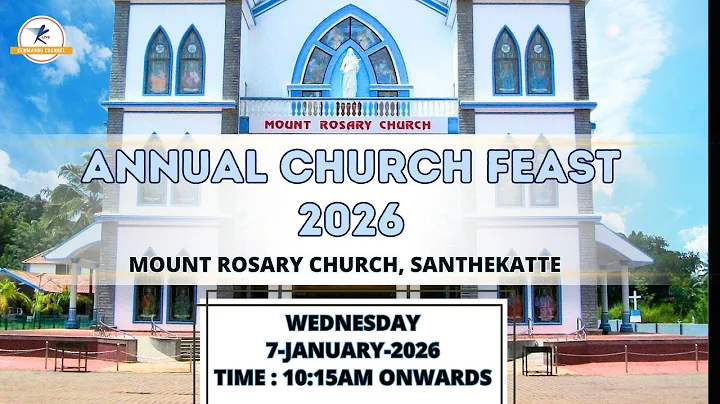

Annual Church Feast 2026 | Mount Rosary Church, Santhekatte | Udupi

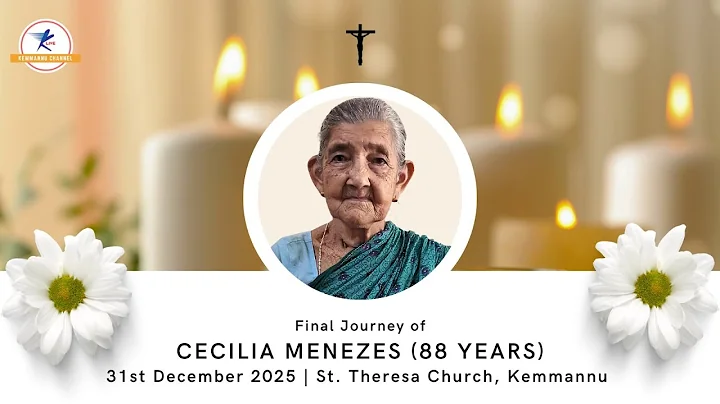

Final Journey of Cecilia Menezes( 88 Years ) | LIVE From Kemmannu | Udupi

New year Mass | St. Theresa Church, Kemmannu | Udupi

Christman Mass | St. Theresa Church, Kemmannu | Udupi

Silver Jubilee Rev. Bishop Gerald John Mathias and Golden Jubilee Rev. Sr. Jaya Mathias, Milagres, Udupi

Annual Day Calebration 2025 | Carmel English School, Kemmannu

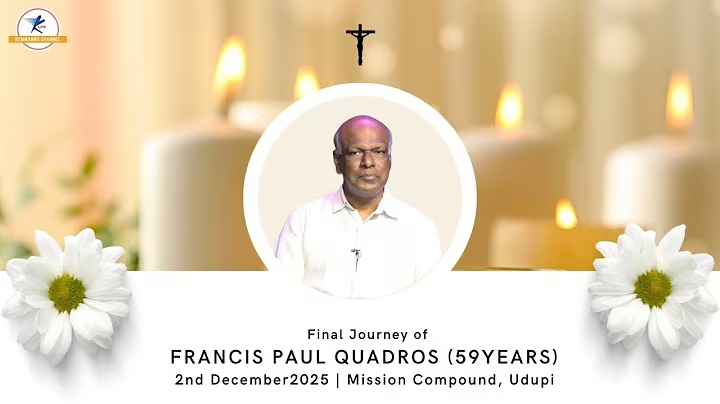

Final Journey Of Francis Paul Quadros (59 Years) | LIVE From Udupi

Land/Houses for Sale in Kaup, Manipal, Kallianpur, Santhekatte, Uppor, Nejar, Kemmannu, Malpe, Ambalpady.

Focus Studio, Near Hotel Kidiyoor, Udupi

Earth Angels - Kemmannu Since 2023

Kemmannu Channel - Ktv Live Stream - To Book - Contact Here

Click here for Kemmannu Knn Facebook Link

Sponsored Albums

Exclusive

A Shepherd Raised by Grace: Rev. Dr Leslie Clifford D’Souza Appointed Bishop of Udupi

Annual Day Celebrated at Carmel English School, Kemmannu

Save Swarna River By Dr Gerald Pinto, Kallianpur

Udupi: Cooking without fire competition at Kemmannu Church [Video]

A ‘Wisdom Home of Memories’, a heritage Museum in Suratkal, Mangaluru

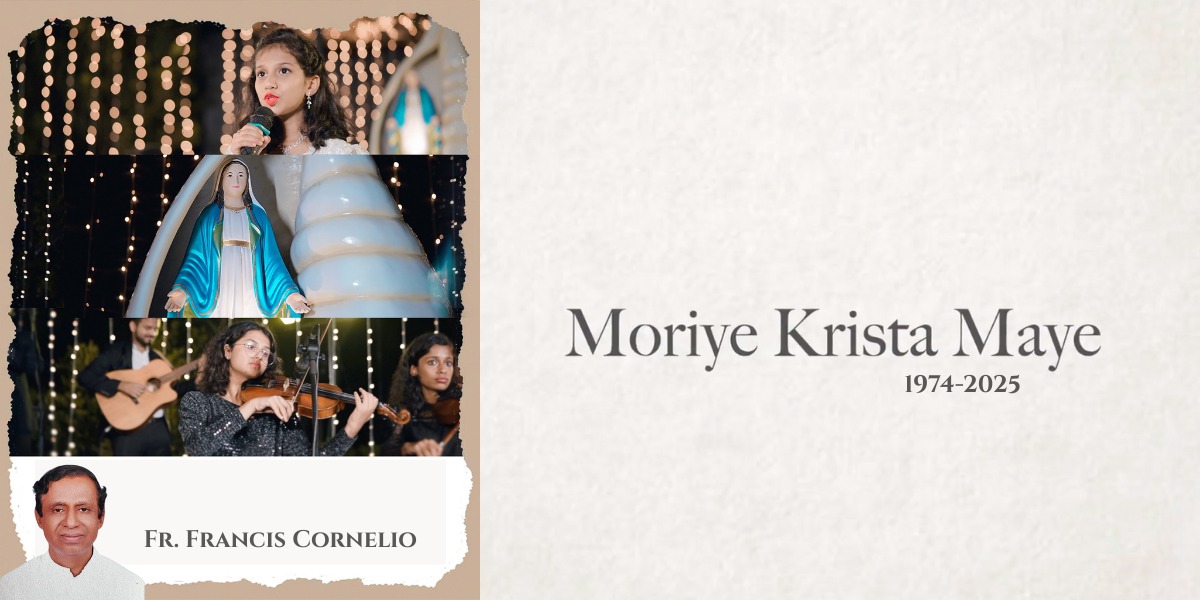

Celebrating 50 Years of Devotion: Iconic Konkani Hymn Moriye Krista Maye Marks Golden Jubilee

Arrest of Nuns’ at Chhattisgarh - Massive Protest Rally in Udupi Echoes a Unified Call for Justice and Harmony [Video]

MCC Bank Inaugurates Its 20th Branch in Byndoor

Mog Ani Balidan’ – A Touching Konkani Novel Released at Anugraha, Udupi [Photographs updated]

TODAY -

TODAY -

Write Comment

Write Comment E-Mail To a Friend

E-Mail To a Friend Facebook

Facebook Twitter

Twitter  Print

Print

Rajeev Nayyer, Advisor, SDHI and (Right) Cmde. K. D. Joshi, Controller of Examinations, IMU at the signing of the MoU.(1).jpg)